high iv stocks nse

Investors can check trading volumes of stocks for weekly monthly or even daily Intraday time periods to make informed investment decisions. Showing page 1 of 8 Industry Export Edit Columns.

Impliedvolatility Indicators And Signals Tradingview

Highest Implied Volatility Options.

. IV stocks Get updates by Email ROE15--DtoE. NSE picks PNB as second stock on F. Short Iron Condors.

Searching for Financial Security. High Implied Volatility Put Options 30062022. Awesome dual golden buy sell filter in one -.

Short Build Up- Put Option. Scan the stocks and see if these reversals are happening at low volume nodes to see if there is clear rejection of the level. Iv rank iv percentile top 20 on wsb.

What is considered to be a high Implied Volatility Percent Rank. Cassava sciences inc com. Bharat Heavy Electricals Ltd.

FO - Listing of Stock With High Put Options Implied Volatility for Indian Stocks near month expiry date 26052022. Position UnWinding- Put Option. 52 Week High 52 Week Low Price Shockers.

The stocks volatility for the past 20 days and the past 1 year is based on the stocks actual price movements. Lets get started today. View stocks with Elevated or Subdued implied volatility IV relative to historical levels.

The above list displays 22 high volatile stocks with high beta. Get a complete list of stocks that have touched their 52 week highs during the day on NSE. Option Screener with High Implied Volatility - NSE.

The Option IV Rank and IV Percentile page shows equity options with the highest daily volume along with their at-the-money ATM average IV Rank and IV Percentiles. Indian Railway Catering Touris. These are High volatile stocks NSE.

India VIX is a volatility index based on the NIFTY Index Option prices. Highlights heightened IV strikes which may be covered call cash secured put or spread candidates to take advantage of inflated option premiums. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

See price trends of raw materials and finished goods. Volatility can benefit investors from every point of view. High Implied Volatility Call Options Expiry 30062022.

Sat May 7th 2022. This can show the list of option contract carries very high and low implied volatility. India VIX uses the computation methodology of CBOE with suitable amendments to adapt to the NIFTY.

Run queries on 10 years of financial data. 10 25 50 100 All. Digital world acquisition corp com.

From the best bid-ask prices of NIFTY Options contracts a volatility figure is calculated which indicates the expected market volatility over the next 30 calendar days. Low Put Call Ratio Volume. Download Smart Options Strategies free today to see how to safely trade options.

Now in the Beta filter just change it to High so that it can only find high Beta Stocks. High PCR Open Interest. High Put Call Ratio Volume.

Option Screener with High Implied Volatility - NSE. Gujarat Narmada Valley Fertilize. The best way to start scanning for high implied volatility will be through the broker that you trade with.

Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. Export import trade data. Ad Actionable unusual options activity front and center.

Download csv As on IST. 52 week high 52 week low prices are adjusted for Bonus Split Rights Corporate actions. High Implied Volatility Put Options Expiry 30062022.

Ad Ensure Your Investments Align with Your Goals. Position Build Up- Put Option. Sign up for InsiderFinance today.

LOSS -012. StocksShares Trading at 52 Week High in NSE. Our Financial Advisors Offer a Wealth of Knowledge.

Implied volatility in stocks is the perceived price movement derived from the options market of that particular stock. Call Options Screener with High Implied Volatility - Indian Stocks. It highlights Stocks ETFs and Indices with high overall callput volume along with their at-the-money Average IV Rank and IV Percentile.

Gujarat Narmada Valley Fertilize. Different brokers have varying levels of sophistication so choose wisely. High Implied Volatility Put.

High Implied Volatility. S1 breakout with volume - - stocks that have seen an sudden rise in their volume by over 2x times the average volume over the past 10 trading sessions and have gained or lost more than 5 today. IDFC First Bank Ltd.

Put Option Most Traded. Implied volatility is presented on a one standard deviation annual basis. High Implied Volatility Call Options 26052022.

Most Active Contracts Most Active Future Contracts Most Active Option Contracts Most Active Calls Most Active Puts Most Active Contracts by OI. As of 27th June 2021 the image also reflects its current price Market Capitalization etc. Top Dividend Yield Stocks Top High Dividend Stocks Top Dividend Paying Stocks.

Hourly pivot reversal - Wick reversal extreme reversal outside reversal and doji reversal. Last-8-days-with-last-5-minute-15-x-50-above - Observe price crossing above ema or sma for. 27 rows Create a stock screen.

Arquit quantum inc com. FO - Listing of Stock With High Call Options Implied Volatility for Indian Stocks near month expiry date 26052022. It can help trader to find the strike to buy or sell.

View Top 100 NSE stocks quoting at a steep discount to its book value. In contrast the implied volatility is derived from options. Find all Low Price High Volume Stocks Low Price High Volume Shares High Volume Low Price Stocks.

Mother candle buy 120min - Mother candle 120 by alfa capital. Most Active Stocks NSE 30. See if stocks are undervalued or overvalued.

Find all NSE. Ad Were all about helping you get more from your money. Higher Implied Volatility Suggest traders are actively trading At this strike Price.

High Implied Volatility Put Options 26052022. A green implied volatility means it is increasing compared to. Most Active NSE indicator identifies stocks with highest trading volumes in a particular day.

This will make the process much easier and depending on the brokerage may even allow you to place orders from within your scanner. Pre-configured baskets of stocks. If XYZ stock is trading at 100 per share with an IV of 20 the market perceives that the stock will be between 80-120 per share over the course of a.

Higher Implied Volatility Suggest traders are actively trading At this strike Price. Short Covering - Put Option. Adani Ports Special Economic Z.

Find a Dedicated Financial Advisor Now. Gujarat Narmada Valley Fertilize. The upper and lower price bands for scrips on which derivative products are available or scrips included in indices on which derivative products are available are.

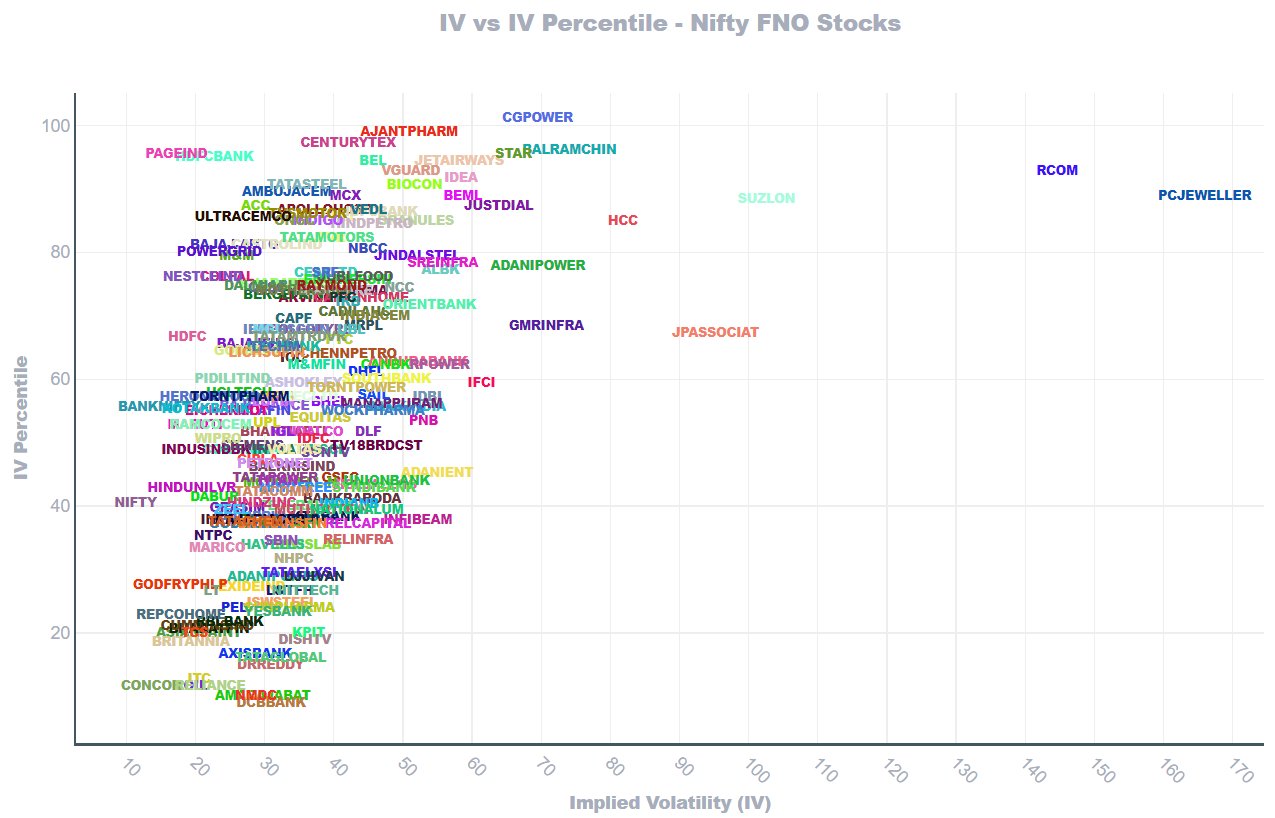

Raghunath On Twitter Inspired From Mrechenthin Iv Vs Iv Rank Visualization Chart I Made A Similar Chart For Nse Fno Stocks I Made Both Iv Vs Iv Rank And Iv Vs Iv

What Is Implied Volatility Option Value Calculator

Impliedvolatility Indicators And Signals Tradingview

How Can We Identify Whether A Stock Option S Implied Volatility Iv Is High Or Low Unlike Index Iv Where We Can Compare It With Vix Quora

Where Can I Find An Iv Chart Implied Volatility For Free Quora

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

Stock Market News Research Panel Investment Advisers Stock Market News Indiabulls Real Estate Up 5 M Stock Market India Stock Market Marketing

Bank Nifty Will Trouble In Financial Sectors Drag India Stock Market Stock Market India Stock Market Financial

Nifty Shorts Via Puts Http Bit Ly 3xebqad Priceaction Elliottwave Trendonomics In 2022 Nifty Waves Elliott

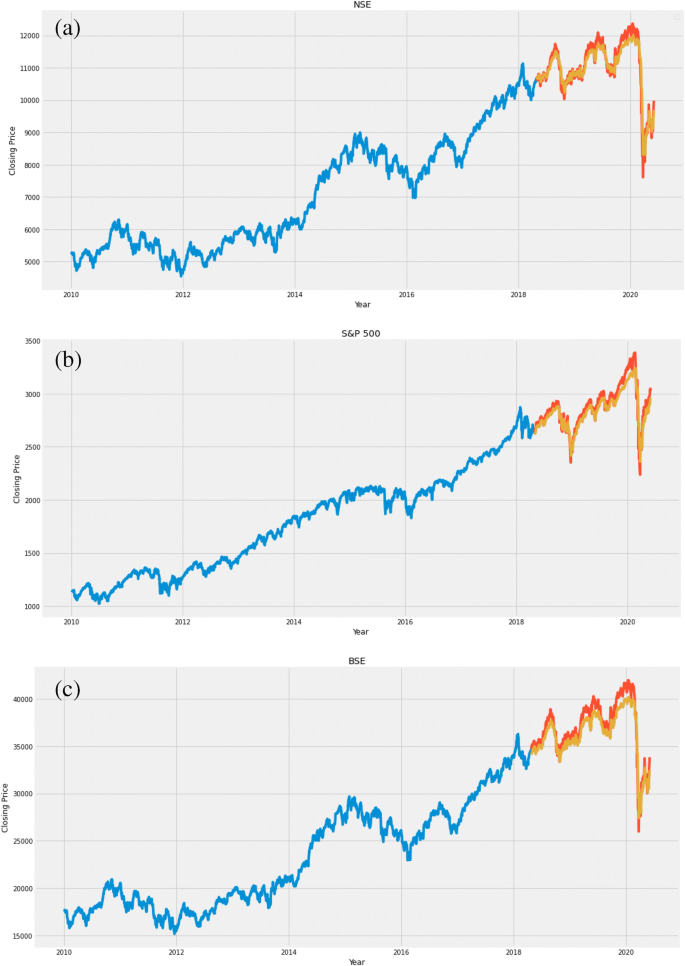

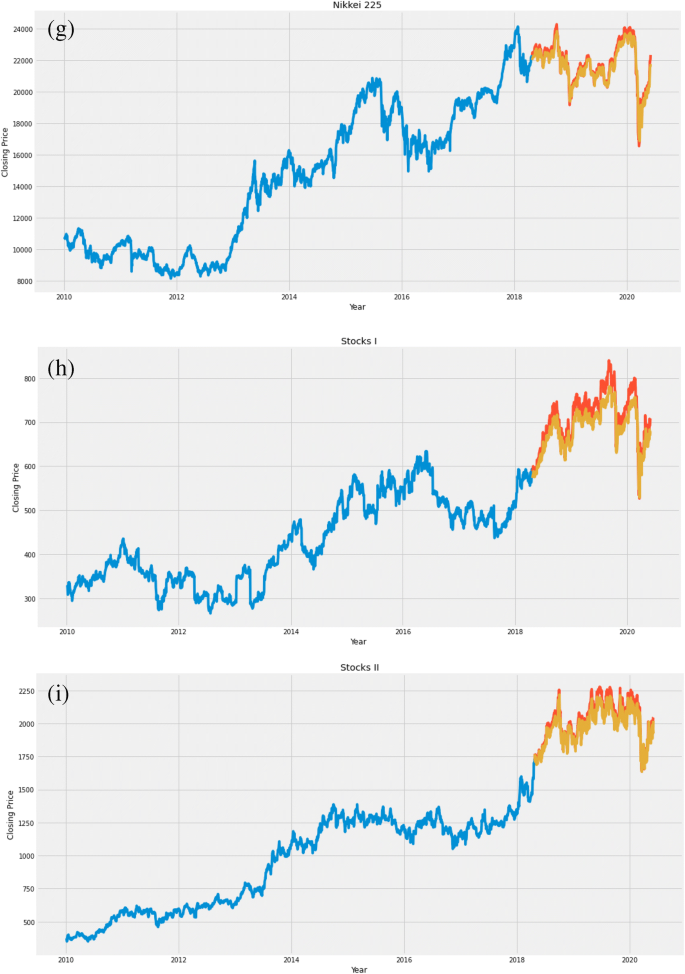

Stocks Of Year 2020 Prediction Of High Variations In Stock Prices Using Lstm Springerlink

How High Is High The Iv Percentile By Sensibull Medium

/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)

Use Options Data To Predict Stock Market Direction

Stocks Of Year 2020 Prediction Of High Variations In Stock Prices Using Lstm Springerlink

How Can We Identify Whether A Stock Option S Implied Volatility Iv Is High Or Low Unlike Index Iv Where We Can Compare It With Vix Quora

What Is Implied Volatility Option Value Calculator

Hv Iv Options Indicator Muthu S By Muthushun Tradingview India

Michael Hart On Twitter Trading Charts Options Trading Strategies Option Strategies

Nifty Reacted Higher Perfectly From Blue Box Area Blue Box Stock Market Nifty

Raghunath On Twitter Inspired From Mrechenthin Iv Vs Iv Rank Visualization Chart I Made A Similar Chart For Nse Fno Stocks I Made Both Iv Vs Iv Rank And Iv Vs Iv